The cost of transporting goods via the China-Europe rail freight link has surged since May, driven by the Red Sea crisis and increased trade activity, with prices continuing to rise this month, according to preliminary data.

Freight rates for trains heading from China to Europe have been on the rise for three consecutive months across major platforms. Prices climbed by 3 to 5 percent in July, 8 to 16 percent in June, and 10 to 20 percent in May, based on data from supply chain services provider Silutuoke. However, this is not an isolated issue, rail freight as a whole has been impacted.

According to data from Costmine Intelligence, there has been a marked increase in all rail freight costs when the data of 500 mile journeys, and 1000 mile journeys are tracked.

Rail transport costs 500-mile and 1000-mile one-way distances. Data presented here represents per-mile rail cost compiled from summaries provided annually by Terry Whiteside, transportation consultant. Source – Costmine Intelligence.

Indications suggest that costs of rail freight between China and Europe will keep rising throughout August and into September, as shown by shipment plans and space-booking rates.

The cost of consignments from Chengdu and Chongqing has risen by an average of USD300 this month, while shipments from Zhengzhou have seen increases ranging from USD200 to USD500.

According to industry sources, space on the China-Europe rail link is likely to remain limited due to sustained strong demand. They attribute the higher rail freight costs to the spike in maritime shipping prices in April and May, stemming from the Red Sea crisis, along with the robust demand for transportation services in Europe.

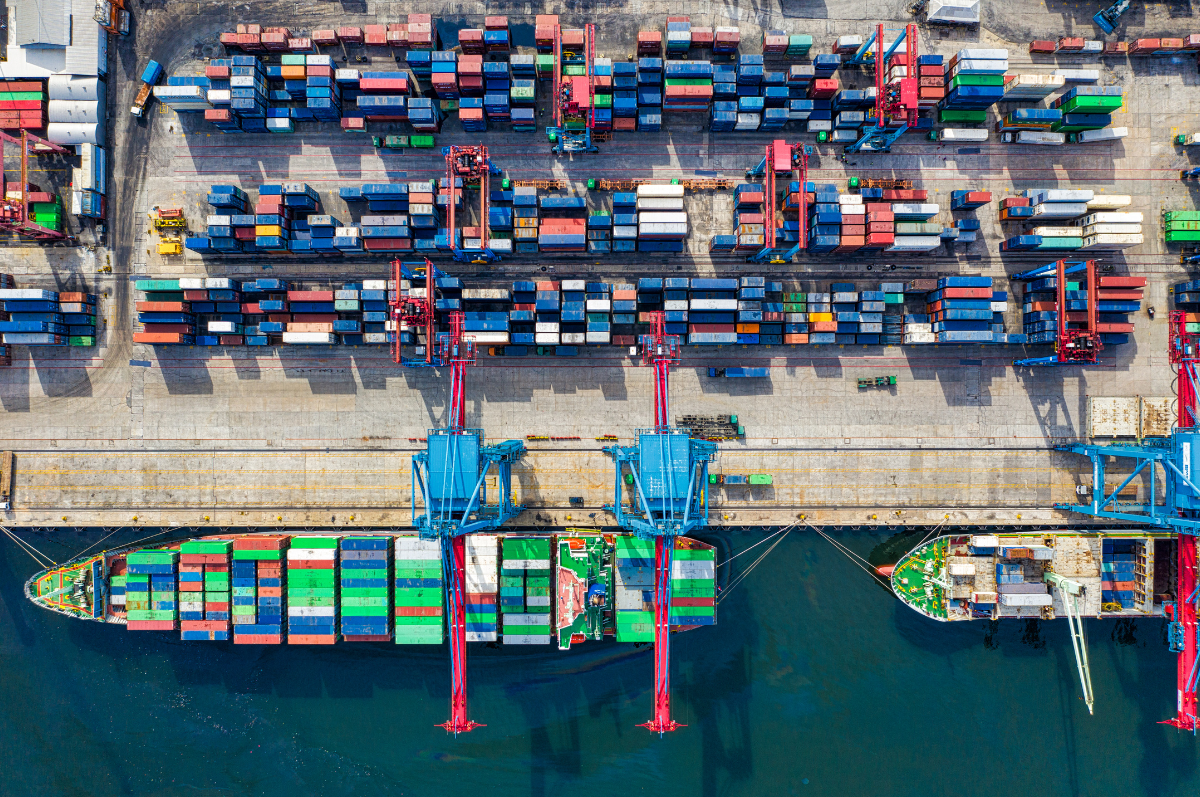

China-Europe freight trains completed 11,403 trips in the first seven months of this year, a 12 percent increase compared to the previous year. Cargo volumes also rose by 11 percent, reaching 1.2 million twenty-foot equivalent units (TEUs), according to China State Railway Group. In July alone, there were 1,776 trips, marking the third consecutive month with over 1,700 trips and delivering 185,000 TEUs.

Container rental costs have been a major factor in the rising shipping prices. At coastal ports, prices exceeded USD3,000 in May when supply was tight, according to Tang Tingting, assistant to the general manager of Sichuan New Silk Road Multimodal Transport. While prices have since dropped to below USD2,000, inland cities like Chengdu, Chongqing, and Xi’an continue to face container shortages, she noted.

Another factor contributing to the container crisis, is that a larger than typical proportion of shipping vessels are unavailable, usually due to refurbishments or repair. It’s unfortunate timing, but hopefully when these become available again, the costs of shipping will drop as a result.

If you need reliable freight services, then please contact us to discuss your needs.