The shipping industry’s decision to divert container vessels around the Cape of Good Hope rather than transiting the Red Sea is set to continue well into 2025. This strategic shift underscores carriers’ prioritization of stability and safety over the risks associated with the Red Sea, despite significant advancements in the Suez Canal’s infrastructure.

Why Avoid the Red Sea?

The decision to avoid the Red Sea arises from persistent security concerns. Attacks on commercial shipping by Iran-backed Houthi forces have created a high-risk operating environment. Since November 2023, Houthi forces have carried out over 100 attacks against commercial ships and warships. Previous incidents prompted carriers to reroute vessels around the Cape of Good Hope, and this cautious approach remains in place as carriers wait for conditions to stabilize fully.

Even as carriers like CMA CGM explore reintroducing Suez transits under naval protection, many shippers remain apprehensive. Their concerns revolve around financial and operational risks, and rebuilding confidence will take time. It is expected that even with a resolution to the Red Sea crisis, diversions around the Cape will persist for several months. Many are waiting to see the incoming US administration’s approach to the Gaza war, the justification claimed by the Houthis as the motivation for their attacks, before making predictions on the risk factors in resuming the Red Sea routes.

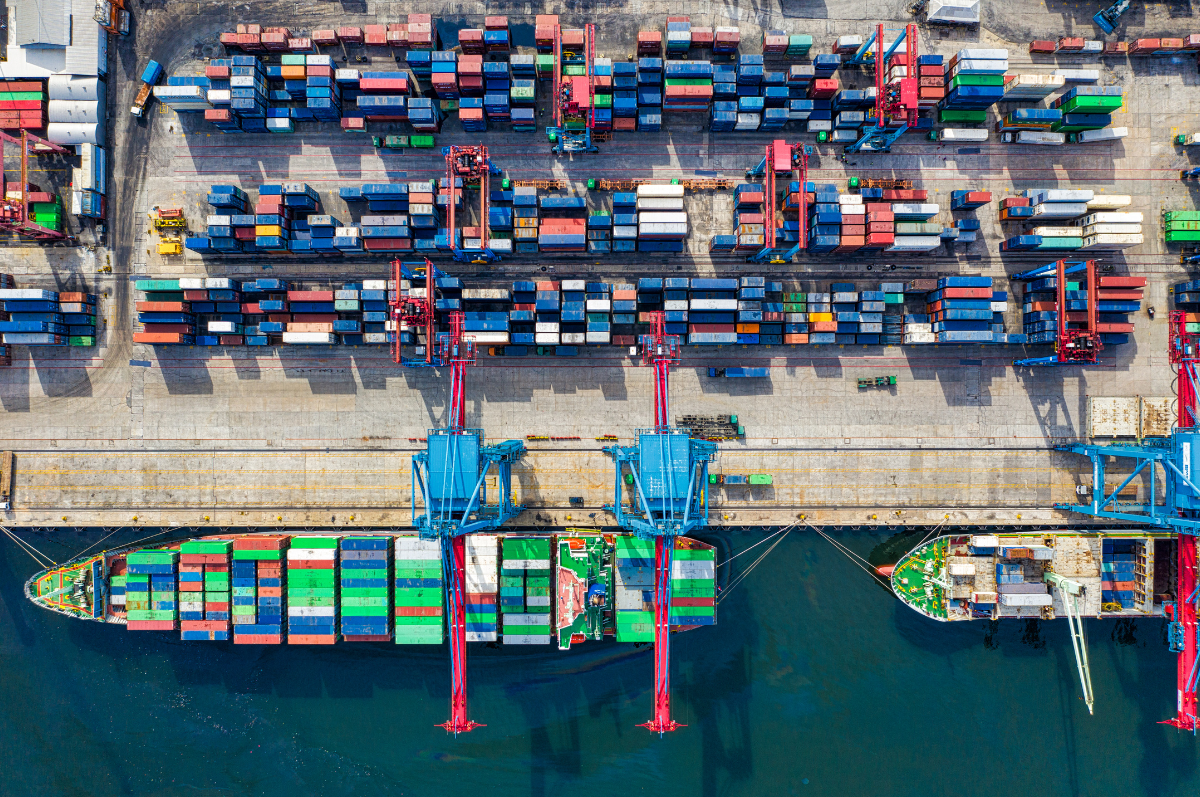

The Impact of the Cape Route

The logistical and operational challenges of reconfiguring networks further support the industry’s current stance. With major shipping lines planning to phase in new networks through February and March, significant adjustments to accommodate Suez transits are unlikely before August 2025.

Shippers, too, are cautious. The longer transit times associated with the Cape of Good Hope route are offset by the reduced risks. Financially, they are also wary of potential general average (GA) liabilities in high-risk zones. Should a ship suffer damage in an attack, the associated cleanup costs and liabilities might not be fully covered by insurers, compounding the financial risks.

Advancements in the Suez Canal

Egypt has made strides in improving the Suez Canal’s capacity and reliability. According to the Suez Canal Authority, the latest expansion extends the total length of the canal’s two-way section to 82 km from a previous 72 km. This extension increases the daily capacity of the 193 km long canal by an additional six to eight ships. This upgrade significantly reduces the chances of disruptions like the “Ever Given” incident, which blocked the canal’s single-lane section for days. They have announced that they are considering further extensions to the canal.

While these improvements enhance the canal’s efficiency and ability to handle emergencies, current demand and geopolitical risks mean the added capacity is not yet essential. However, the revenue of the canal has dropped by 60% since 2023 – approximately $7 billion, so additional works and incentives may be in the works. For now, carriers and shippers alike are placing a higher premium on stability and security.

Building Resilient Supply Chains

As geopolitical risks continue to influence global shipping, resilience remains the watchword for the industry in 2025. Shippers must focus on building robust supply chains, securing comprehensive cargo insurance, and managing budgets to navigate this complex landscape effectively.

While the Suez Canal is poised to reclaim its status as the preferred route in the future, the detours around the Cape of Good Hope highlight the industry’s adaptability and commitment to ensuring safe and reliable global trade.

Hawley Logistics have extensive experience navigating these challenges, and freight logistics globally. If you need assistance with your supply chain or shipping challenges, then please contact us to discuss your needs.