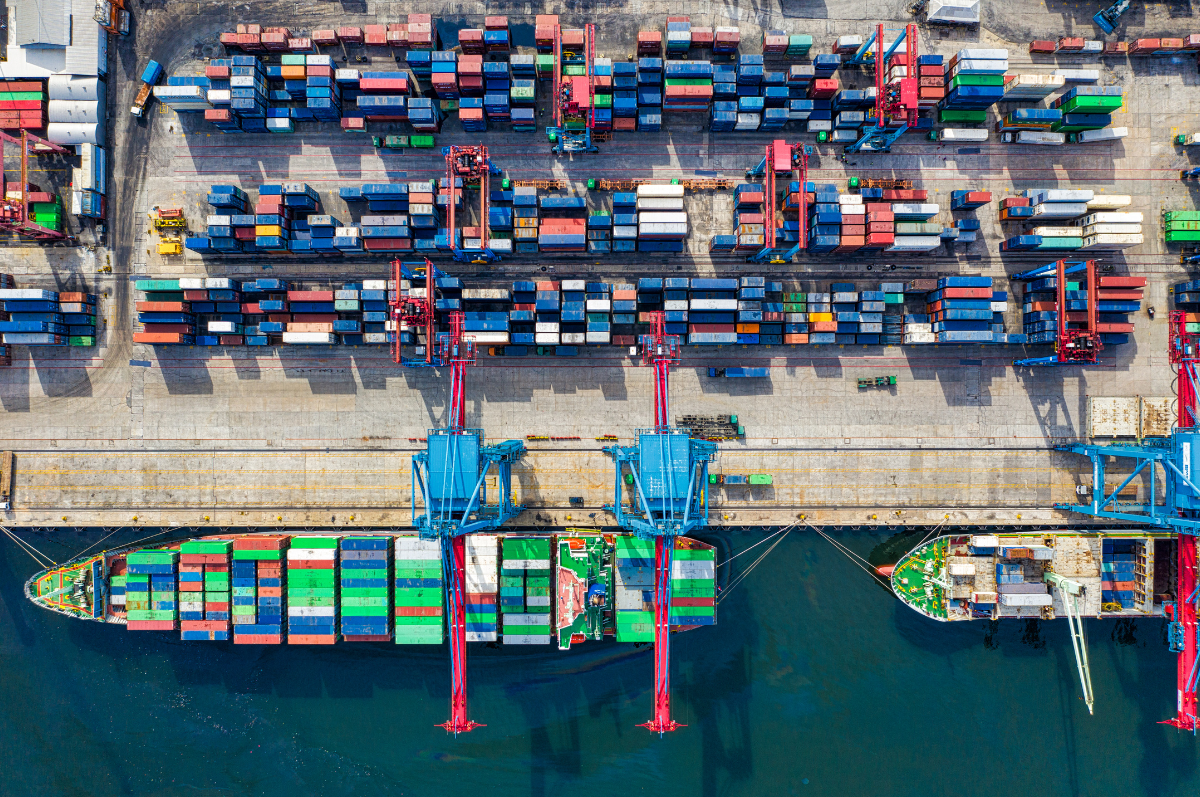

Ports along the U.S. East Coast and Gulf Coast have reopened following the resolution of a significant labour dispute between dockworkers and port operators. This development ends the largest work stoppage seen in the industry in nearly fifty years. However, despite the breakthrough, experts warn that it will take some time to clear the cargo backlog that accumulated during the short strike.

The work stoppage, which took many by surprise, was resolved quicker than investors anticipated, dampening expectations of a surge in freight rates. As a result, shipping stocks fell as the anticipated disruption to supply chains was avoided. According to Ryan Sweet, Chief U.S. Economist at Oxford Economics, “The port strike ended fairly quickly, removing any significant downside risk to the economy this quarter.”

At the height of the strike, which began on the 1st of October, at least 54 container ships were reported to be waiting outside the ports, unable to unload their cargo. This backlog posed a risk to the availability of a wide range of goods, from foodstuffs like bananas to essential auto parts, as reported by Everstream Analytics. More vessels are expected to arrive, further adding to the pressure on port operators and workers.

Xeneta, a leading pricing platform, estimates that it could take between two to three weeks for the usual flow of goods through the ports to be restored. Peter Sand, Chief Analyst at Xeneta, emphasised that the challenge is not just to clear the vessels currently queued up but to deal with incoming ships while attempting to reduce congestion. He noted, “Remember that ships keep calling, so it’s not just a matter of handling the ships already in line, but to work extra hard to run down the congestion before supply chains are rerunning.”

The resolution came late on the 4th when the International Longshoremen’s Association (ILA), representing around 45,000 dockworkers, and the United States Maritime Alliance (USMX), which represents port operators, reached a wage agreement. According to sources familiar with the negotiations, the deal includes a wage increase of approximately 62% over six years, raising the average hourly wage from $39 to around $63. This marked the end of the ILA’s first major work stoppage since 1977, which affected 36 ports stretching from Maine to Texas.

JP Morgan analysts estimated that the strike was costing the U.S. economy roughly $5 billion per day. The timing of the strike was particularly concerning for President Joe Biden’s administration, with the stoppage potentially impacting employment figures ahead of the upcoming presidential election on 5th November. Democratic Vice President Kamala Harris faces off against former President Donald Trump in what is expected to be a closely contested election. A disruption of this magnitude, if it had continued, might have had wider economic implications, potentially influencing voters.

The swift resolution of the strike came as a relief to many, but it also led to a drop in shipping stocks as expectations for increased freight rates due to prolonged disruptions were dashed. Shares in shipping companies across Asia and Europe took a hit following the deal’s announcement. For example, A.P. Moeller-Maersk fell by 4.7% on Friday morning, while Hapag-Lloyd dropped by 14.4%. Japan’s Nippon Yusen saw a 9.4% decline, and Kawasaki Kisen lost 9.7%. Tony Huang, an analyst at Taishin Securities Investment Advisory, remarked, “Shipping stocks had previously rallied on expectations of price increases triggered by the strike by U.S. dockworkers and the tense situation in the Middle East.”

The impact of the strike was particularly concerning for the retail sector, which accounts for around half of all container shipping volume. Major retailers such as Walmart, IKEA, and Home Depot depend heavily on ports along the East and Gulf Coasts. According to Sky Canaves, an analyst with eMarketer, these companies were bracing for potential disruptions, though many had prepared by stocking up early for the holiday season. Bill of lading data from Import Yeti revealed that IKEA, Walmart, and Goodyear Tire & Rubber were among the largest importers affected by the port closures.

While the immediate crisis has been averted, coffee prices have risen as a result of the port disruptions, reflecting the wider-reaching impact on various consumer goods. However, with the ports now reopening, retailers and importers are hopeful that the situation will stabilise.

The agreement between the ILA and USMX only extends the current contract until 15th January, meaning further negotiations on unresolved issues will continue. Automation remains a key point of contention, as workers argue that increased automation at ports could result in significant job losses.

The National Retail Federation welcomed the news of the ports reopening, stating, “The decision to end the current strike and allow the East and Gulf coast ports to reopen is good news for the nation’s economy. The sooner they reach a final deal, the better for all American families.”

The tentative deal on wages has provided a temporary solution, but the prospect of further negotiations means there is still some uncertainty on the horizon for both workers and businesses relying on these crucial supply chain links.

If you have any questions regarding Sea Freight or need to arrange your own shipping, then please contact us to discuss your needs.